- Tesla’s recent controversy includes vehicles being targeted in protests, involving Molotov cocktails due to public unrest over political alliances.

- Commerce Secretary Howard Lutnick endorses Tesla as an investment, raising questions about ethics due to government officials promoting private companies.

- The political tension stems from Elon Musk’s support of a federal workforce reduction initiative linked to the Trump administration.

- Tesla faces financial struggles, public discord, and product recalls, notably with the Cybertruck, complicating its public image.

- Debates continue over the ethical boundaries of government involvement in private sector endorsements.

- The situation highlights the complex relationship between innovative enterprises and political dynamics, with ongoing scrutiny on public endorsements.

- Tesla’s future remains uncertain amid these intersecting challenges of profit, politics, and innovation.

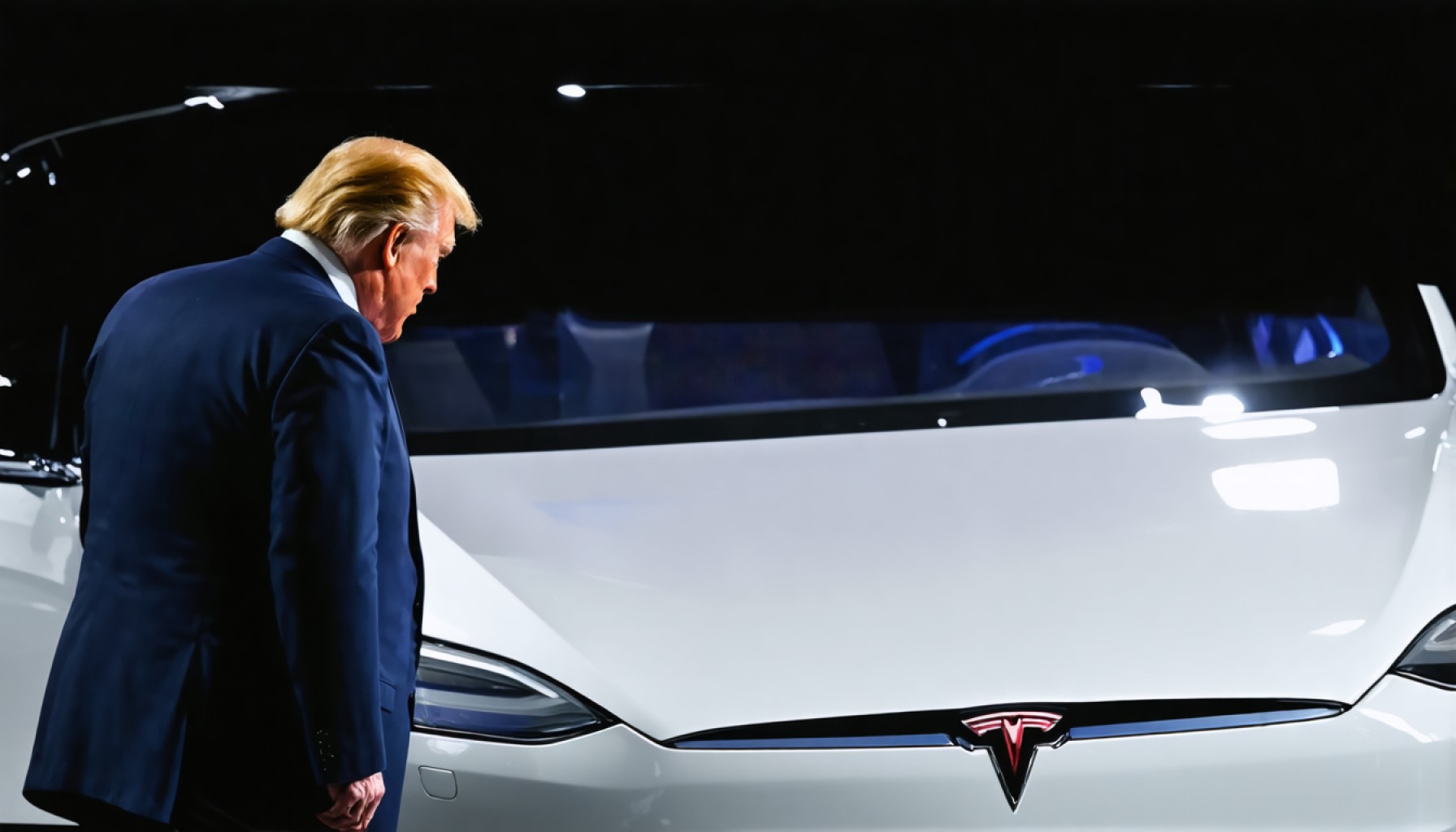

The sharp elegance of Tesla’s electric vehicles often grabs the spotlight, but lately, another form of sparks has caught the nation’s attention: flames erupting from Tesla cars as disgruntled protesters hurl Molotov cocktails. At the heart of this chaos is a surprising advocate—Commerce Secretary Howard Lutnick—who publicly urges people to invest in the beleaguered company. This endorsement not only breaks tradition but raises ethical questions about mingling government roles with private enterprise.

Against the backdrop of Washington’s majestic South Lawn, Lutnick recently strode alongside Tesla’s enigmatic CEO, Elon Musk. He passionately recommended Tesla as a worthwhile investment, despite its stock being battered down by more than 50% since December. This recommendation marks an extraordinary departure from typical governmental neutrality, as ethics rules generally forbid federal officials from promoting private endeavors.

Tesla’s struggle is not purely financial turmoil. The brunt of public discord stems from Musk’s audacious support of the Trump administration’s controversial DOGE initiative, aimed at reducing the federal workforce. Musk’s open support for Trump has inflamed tensions, leading to acts of vandalism targeting Tesla assets across the United States. Disillusioned citizens have taken to the streets in protest, echoing their disdain for what they see as a brazen political alliance.

While Musk’s technological feats—from self-driving cars to humanoid robots—consistently push the boundaries of innovation, this latest twist signifies a stark collision between business ambition and political allegiance. Secretary Lutnick, formerly of Wall Street’s renowned Cantor Fitzgerald, insists that Musk’s visionary projects will eventually vindicate his current champions, relegating today’s skepticism to the pages of the past.

The White House, meanwhile, attempts damage control with press narratives lauding Tesla as a pillar of American manufacturing, despite the controversy. Yet, tension lingers as the ground beneath Tesla’s wheels remains rocky. Amidst the political theatrics, there’s a new legal pothole: a recall concerning Tesla’s futuristic Cybertruck. With panels at risk of flying off, this mechanical flaw adds to the company’s polarizing saga.

Former ethics clashes during Trump’s first presidential tenure highlight a recurring theme—governmental figures playing dual roles as supporters of closely-tied commercial entities. As Lutnick’s remarks reverberate across media channels, they stir debates about the boundaries of official endorsements, reminding us of the fragile balance between private initiatives and public responsibility.

In this unfolding drama, one thing is clear: the intersection of profit and politics is more tumultuous—and more scrutinized—than ever before. Whether Tesla’s stock rebounds or continues its descent, the spotlight remains fixed on those who choose to navigate these intersecting worlds. Ultimately, in a nation where innovation reigns but partisanship simmers, the call to invest in Musk’s empire is as provocative as it is controversial.

Tesla’s Turbulent Journey: The Collision of Innovation, Politics, and Public Perception

Key Facts and Insights

Tesla’s Financial Struggles and Market Volatility:

Tesla’s stock has experienced significant downturns, with more than a 50% drop since the previous December. This kind of volatility isn’t uncommon in the tech and automotive sectors, particularly for companies known for their rapid innovation and extensive capital investment requirements.

Political Endorsements and Ethical Questions:

Commerce Secretary Howard Lutnick’s unusual endorsement of Tesla raises significant ethical concerns about government figures endorsing private companies. Typically, federal officials adhere to strict guidelines that prevent them from promoting specific enterprises to maintain impartiality.

Public Protests and Vandalism:

The controversy surrounding Elon Musk’s political affiliations has incited acts of vandalism against Tesla, emphasizing a larger cultural resistance towards perceived political alliances within big tech companies.

Legal and Mechanical Challenges:

The recall of Tesla’s Cybertruck due to potential panel detachment exemplifies the technical challenges faced by Tesla. While renowned for its cutting-edge designs, Tesla’s rapid development pace sometimes results in quality control issues.

Market Forecasts and Industry Trends

Electric Vehicle (EV) Adoption:

Despite recent obstacles, the global electric vehicle market is projected to grow significantly in the coming years. The International Energy Agency (IEA) forecasts that the number of EVs on the road will increase dramatically by 2030, as more countries push towards automation and reducing carbon emissions.

Tesla’s Competitive Landscape:

While Tesla has been a leader in the EV market, traditional automakers like Ford, GM, and emerging players like Rivian and Lucid Motors are ramping up their electric vehicle offerings, increasing competition.

Pros and Cons Overview

Pros:

– Innovation Leader: Tesla continues to push boundaries in autonomous driving, battery technology, and renewable energy solutions.

– Strong Brand Loyalty: Despite controversies, Tesla maintains a devoted customer base known for their brand loyalty.

Cons:

– Political Controversies: Musk’s political alignments and Tesla’s support of controversial policies have impacted public perception.

– Product Recalls: Recurring issues with vehicle recalls can affect consumer trust and company’s financial stability.

Pressing Questions and Answers

Why is Tesla’s stock so volatile?

Tesla’s stock volatility stems from rapid market shifts, policy changes, and the high expectations placed on technology-driven companies. Investors react dramatically to news related to innovation cycles, market demand, and political influences.

Is investing in Tesla beneficial right now?

Investing in Tesla should be approached with caution due to its current market dynamics and public controversies. Potential investors must weigh long-term growth prospects against short-term volatility and ethical considerations.

Actionable Recommendations

– Stay Informed: Follow credible financial news sources and market analysts for the latest insights on Tesla and the broader EV industry.

– Diversified Portfolio: Consider diversifying investments to mitigate risks associated with the volatility in tech and automotive sectors.

– Monitor Political Climate: Recognize how political affiliations and endorsements can impact company reputation and stock performance.

For more insights into electric vehicles and market trends, visit the official Tesla website at Tesla.

By keeping informed about these factors and adopting a measured approach, you can make more informed decisions amidst the fluctuating intersection of Tesla’s innovation and political influences.